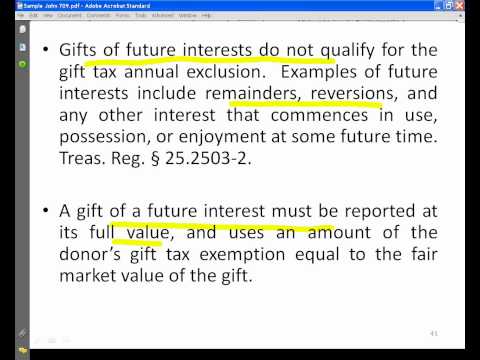

In disaster on highway seven or nine webinar, a couple of things that we're going to go through today. We're going to go through some common mistakes that we've seen on gift tax returns. It's extremely important this year because of the number of gift tax returns that are going to be filed that we prepare these correctly. To help make sure we use the right amount of the lifetime gift exemption available to the clients and that we also provide full and adequate disclosure. What we've also done is at pages 53 through 58 of the PowerPoint, we provided a checklist. This is pretty much all the information you're going to need to ask for from a client to prepare the gift tax return for them. And then at pages 59 and 60 of the PowerPoint, I have a fact pattern which we generated to be able to produce two sample 709 s. The sample 709 s were also sent to you, they're separate PDFs. And we'll go through those as well as we're going through the program. So that being said, we'll go ahead and get started, okay? So during 2011, the lifetime gift tax exemption was increased from 1 million dollars to five million dollars. That amount was increased to 5 million 120 thousand dollars for 2012. And originally it was scheduled if Congress took no additional action that on January 1st, 2013 the last time gift exemption would be reduced back to 1 million dollars. Now I'm sure everyone's aware Congress did act, they've extended the gifting allowance made a permanent and it's indexed for inflation. So it's actually increased to five million two hundred fifty thousand dollars. But because there was such uncertainty and what happened is most of our clients and if they didn't make...

Award-winning PDF software

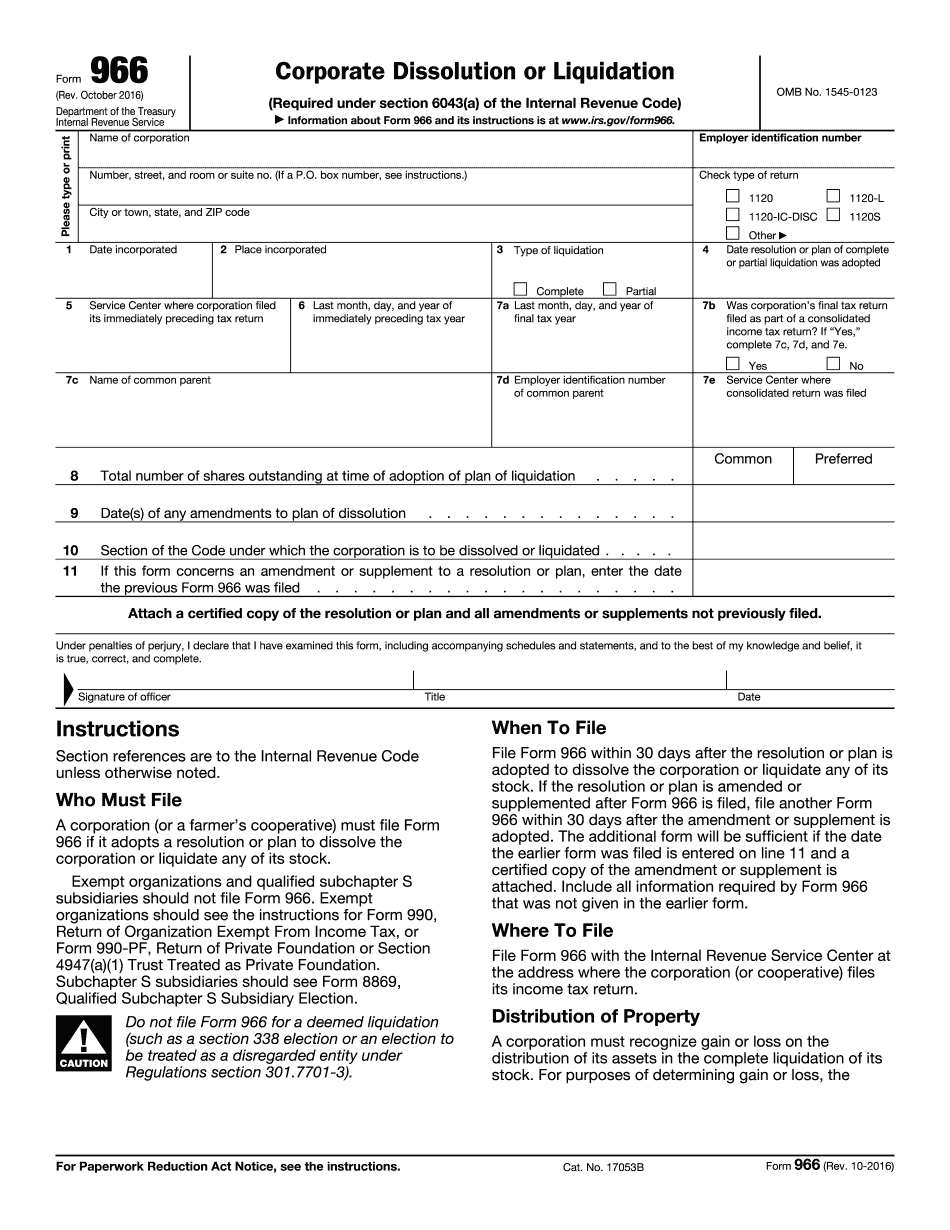

Video instructions and help with filling out and completing Can Irs Form 966 Line 10