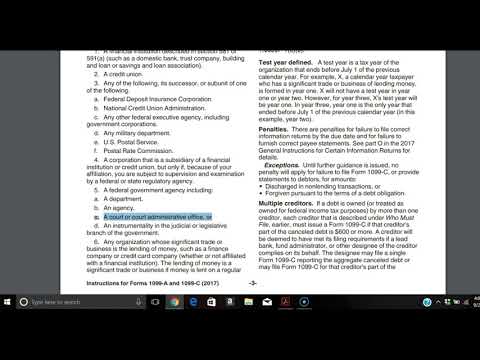

All right, what's up everybody? Just really coming back to you guys once again. Now that we have covered 456 as it pertains to court cases and the IRS and things of that nature, now we're gonna go ahead and look at why you have to incorporate the IRS on the public side of any court case as it pertains to your legal estate, aka your name in all caps letters. So, under Rule 17, what they're doing is the judge is administering your estate. It forms a constructive trust and then raises the estate and makes the corporate state of or process, i.e., the prosecution beneficiary to that trust. And that trust is public. It's enlisted as a publication under IRS Publication 559. And the liability of the beneficiary, they have to pay the income taxes on an estate because if you had a judgment ruled against you and they're favored, you're responsible as a qualified heir under 2030-811 of the Internal Revenue Code Title 26 and produce 1099-C, as well as attached with 1099-A. And I'm going to show you guys my proof of claim in which it states that the court has to file a 1099-A as well as a 1099-C. This is the 2017 instructions for forms 1099-A, 1099-C. So we're gonna find out which it states right here. You must file, give me one second. Okay, so yeah, here it goes right here. A court or a court administrative office because once again, they're administering for that trust state in which the public, it's a dead entity because it's bankrupt. So they have to be bonded. That's why a lot of these courts, you know, they don't produce the bond as well as the W-9 form with their EIN. So when they don't do that,...

Award-winning PDF software

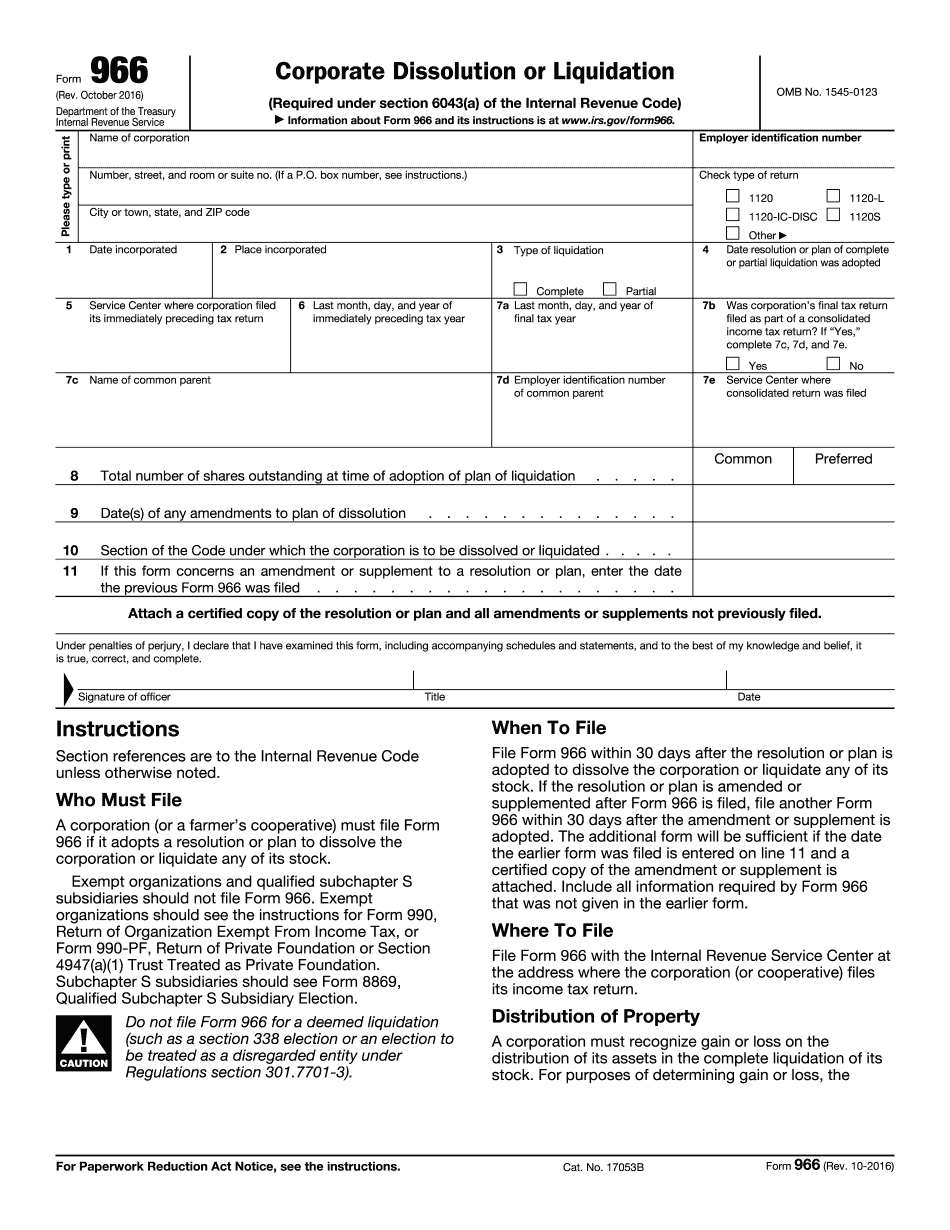

Video instructions and help with filling out and completing File Irs Form 966 Online