Hi, this is John with PDF Tax. This here is our first look at Form 1040 for 2018. It's a new form, a new tax law. It is the draft copy that was released on June 29th, so it still has the watermark on it as you can see. You might recall that President Trump had promised to reduce the form 1040 to the size of a postcard, and so this is it, a lot different than what has been in prior years. But it does have a second page to it, which is right here, still though a lot smaller than 1040 was in prior years. So, what the IRS has done is they have created six new schedules to capture the information that used to be on the 1040. Schedule one is additional income and adjustments. Schedule two is tax. Schedule three is non-refundable credits. Schedule four is other taxes. Schedule five is other payments and refundable credits. And schedule six is foreign address and third party designee. Now, if you take a closer look at the form 1040 here, one of the first things you're probably going to notice is that right here is that there's only three filing statuses. Last year, there were five. The tax law has changed, of course, but that part has not changed. There's still five filing statuses. So, you have to wonder if you're single or if you're married filing joint, how do you tell the IRS or how do you indicate on this form that that's the case? Well, we won't know for sure until the instructions for this form come out, but I'm pretty sure that the way it's gonna work is this. If you enter your name and social here, just one name, and one social, the IRS is going...

Award-winning PDF software

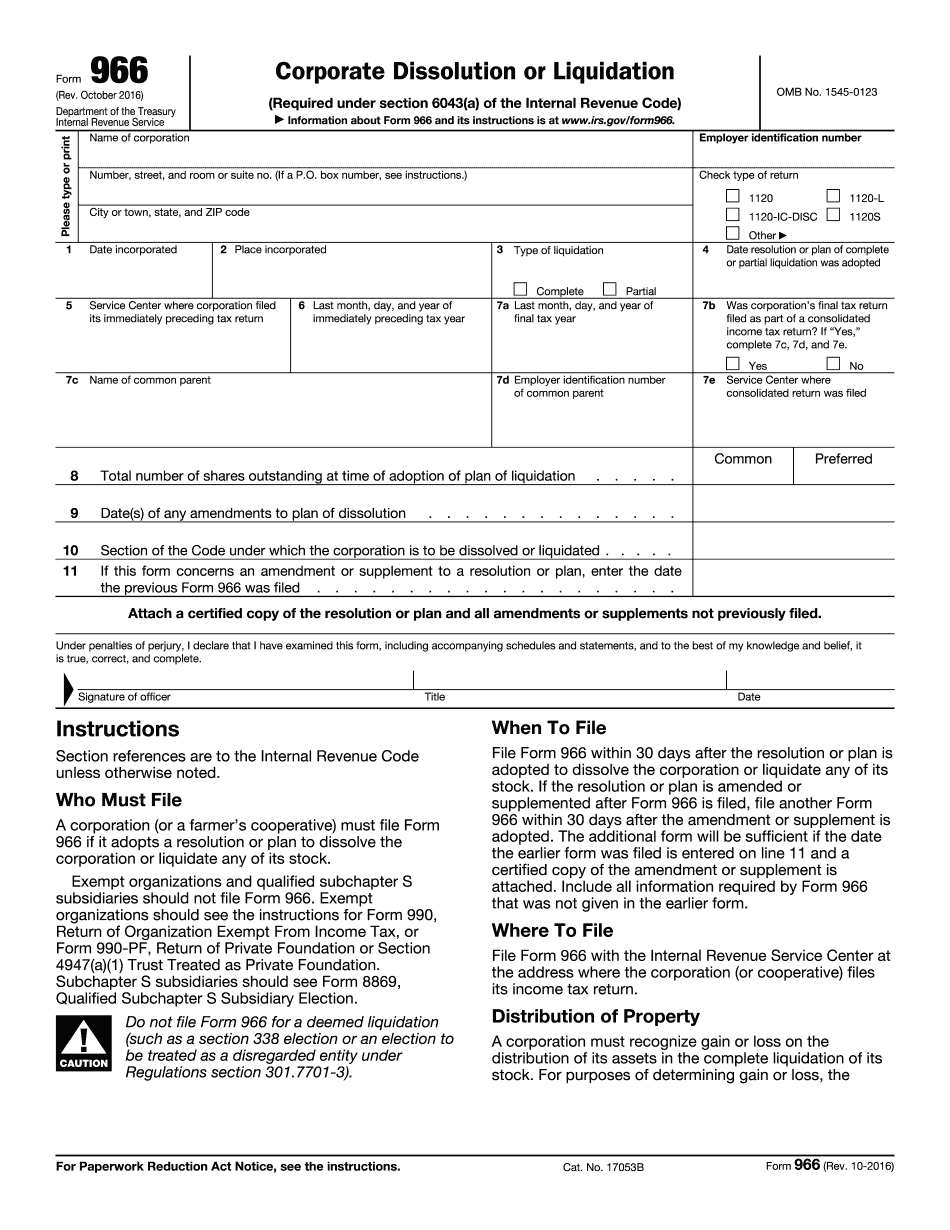

Video instructions and help with filling out and completing How To Complete Irs Form 966