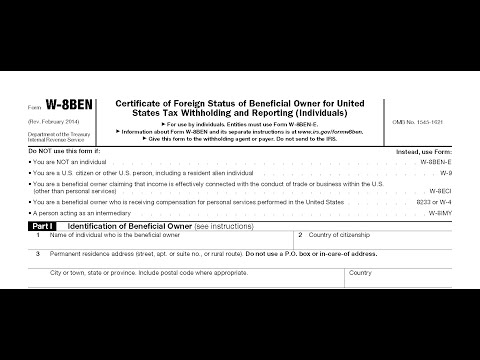

Today we're going to talk about IRS Form W-8BEN, which is the Certificate of Foreign Status of Beneficial Owner for United States Withholding and Reporting for Individuals. The primary purpose of Form W-8BEN is to establish that an individual is a foreign person and not a U.S. person. It is a relatively short form, only one page long. Although the primary purpose of the form is to certify the foreign status of the individual, the form can also be used to claim treaty benefits. In contrast, entities must fill out Form W-8BEN-E. The term "beneficial owner" essentially means the owner of the income being received and that person cannot be a nominee or an intermediary. The terminology can be a little confusing because the person making the payment usually has deductible expenses and does not have income. However, for the foreign recipient or foreign beneficial owner, it is considered income. The U.S. imposes a 30 percent withholding tax on certain types of payments of U.S. sourced income to foreign persons. The payor of the income is obligated to withhold U.S. tax, unless an exception applies. The payor is referred to as a withholding agent because they may need to withhold U.S. tax. The typical types of income subject to the withholding tax include dividends, interest, rents, royalties, and compensation for services. However, it's important to remember that only U.S. sourced income is subject to the 30 percent withholding tax. If the payment is for services that take place entirely outside the U.S., then it is not considered U.S. sourced income and the 30 percent withholding tax does not apply. However, it becomes more complicated if any services are rendered in the U.S. These withholding rules can get tricky when making payments to individuals outside the U.S. who happen to be U.S. citizens. In such cases,...

Award-winning PDF software

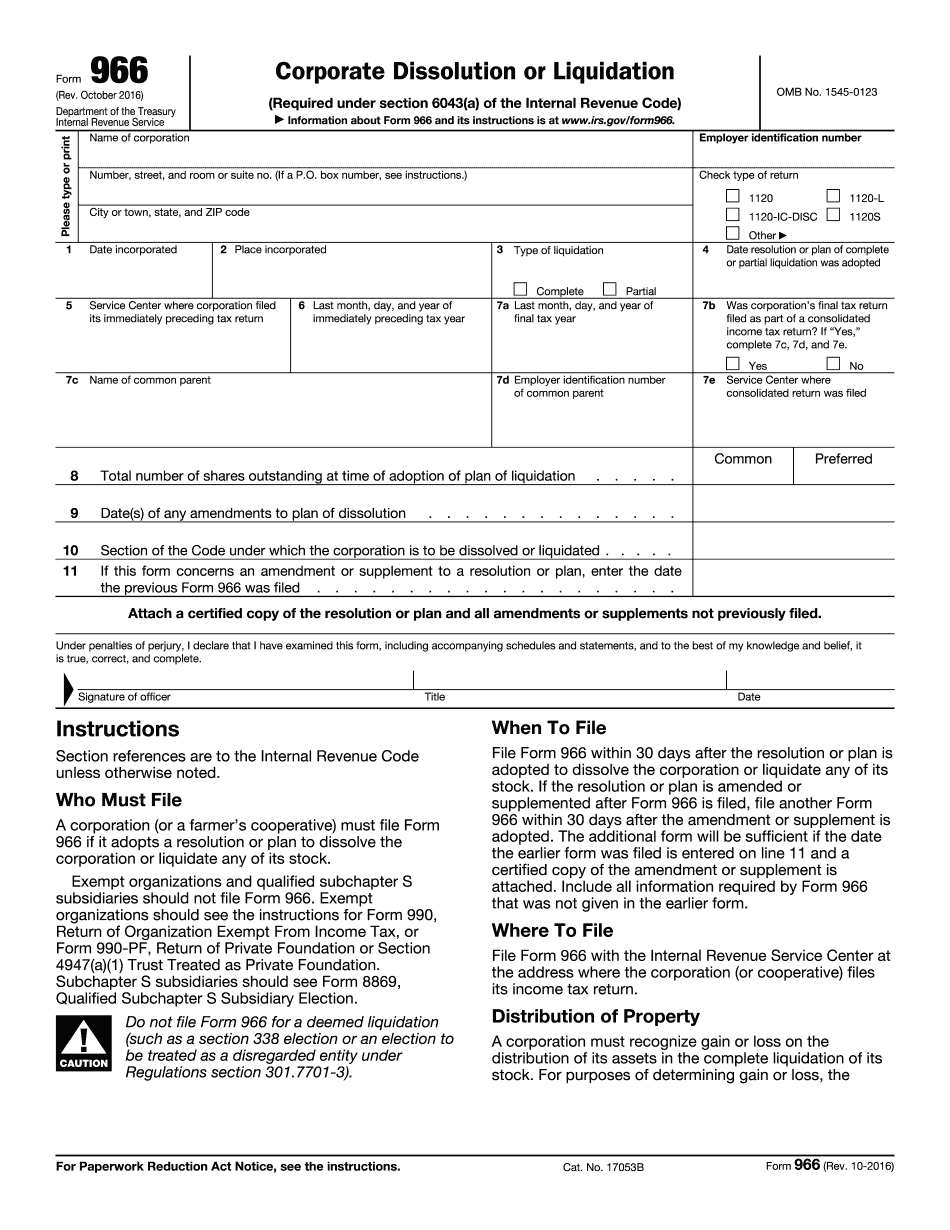

Video instructions and help with filling out and completing Irs Form 966 Llc