Hi, my name is Rose Bolton. I am an enrolled agent from the California Society of Enrolled Agents Education Foundation. Today on Tax News Live, I will discuss how to close a California business entity. Business entities registered with the California Secretary of State can dissolve, surrender, or cancel their businesses in California. The process differs based on the type of entity. Domestic corporations, which are originally incorporated in California, may legally dissolve. Foreign corporations, which are originally incorporated outside of California, may legally surrender. Limited liability companies and partnerships, both domestic and foreign, may legally cancel their businesses. These actions are taken when the entities are ceasing operations in California and need to terminate their legal existence. I'm Alvaro Hernandez, the Franchise Tax Board small business liaison. Now that Rose has gone over the definitions, I want to share with you the steps that you need to take to properly close your business entity. Firstly, you need to file any delinquent tax returns. Secondly, you need to make sure you pay any outstanding balances, including penalties, fees, and interests. Finally, you need to file a final return for the current year or the final year. On top of that return, you need to write "final" and check the that says "final return." You also need to file the appropriate forms with the Secretary of State within a 12-month period of time. For more information, you can visit the Secretary of State's website or give them a call. Additionally, it's important to know that if your business entity is currently suspended, you must revive it before you can close with the Secretary of State. To do this, you'll need to file any delinquent tax returns and pay any tax liabilities. If you have any questions, you can contact us. We can help. Good luck! Now back to...

Award-winning PDF software

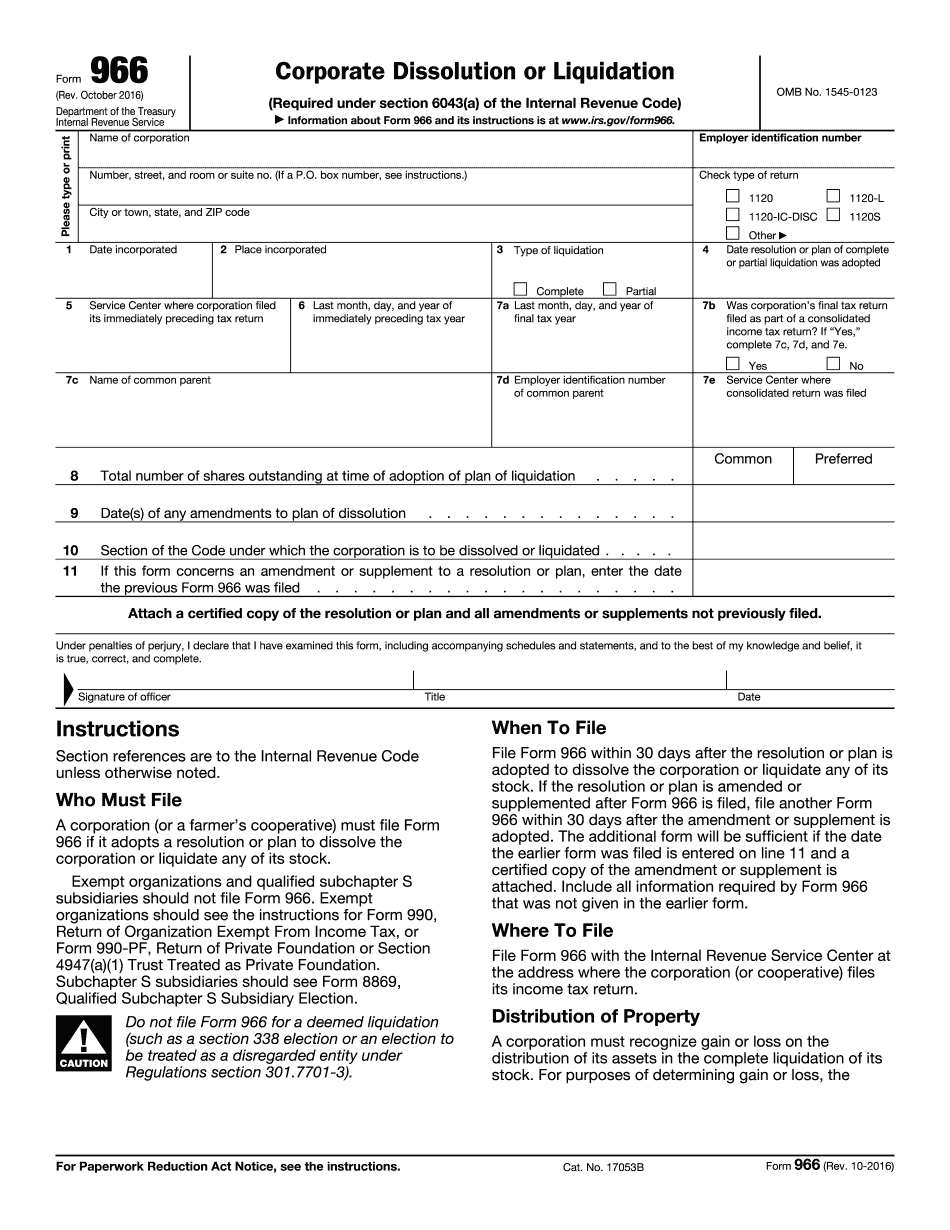

Video instructions and help with filling out and completing Irs Form 966 Penalties