Music, hello and welcome. In this video, we're going to talk about IRS Form 2848, power of attorney, and declaration of representative. We will explain what this form authorizes and who should use it, plus some helpful tips to make sure the IRS will approve your request for power of attorney. Let's jump right in! Tip number one: What is IRS Form 2848 and who should use it? Only certain people can be granted power of attorney using Form 2848. For tax professionals, that group includes attorneys, CPAs, and enrolled agents. This form allows tax professionals to represent their clients before the IRS as if they were the taxpayer. There are a number of reasons this type of representation may be necessary. Maybe your client is out of the country during tax season or they're limited in their ability to communicate because of a medical condition. Maybe you represent a corporation or individual with unresolved tax debt. The 2848 allows you to define and limit the scope of the authority your client wishes to grant, but more on that in a moment. A successfully filed 2848 also gives a tax professional the authority to receive confidential tax information for their client, including tax returns, transcripts, and IRS notices. However, if you're only looking for access to your client's tax documents, you may be better off using the much simpler Form 8821. Tip number two: Be specific on line three. The 2848 gets rejected a lot, and it's usually because people don't follow the instructions when filling out line three. While filling out this section, you must clearly state the specific issue or issues that you're requesting authorization for. This includes the nature of the issue, the types of forms involved, and the specific period of time that this authority will...

Award-winning PDF software

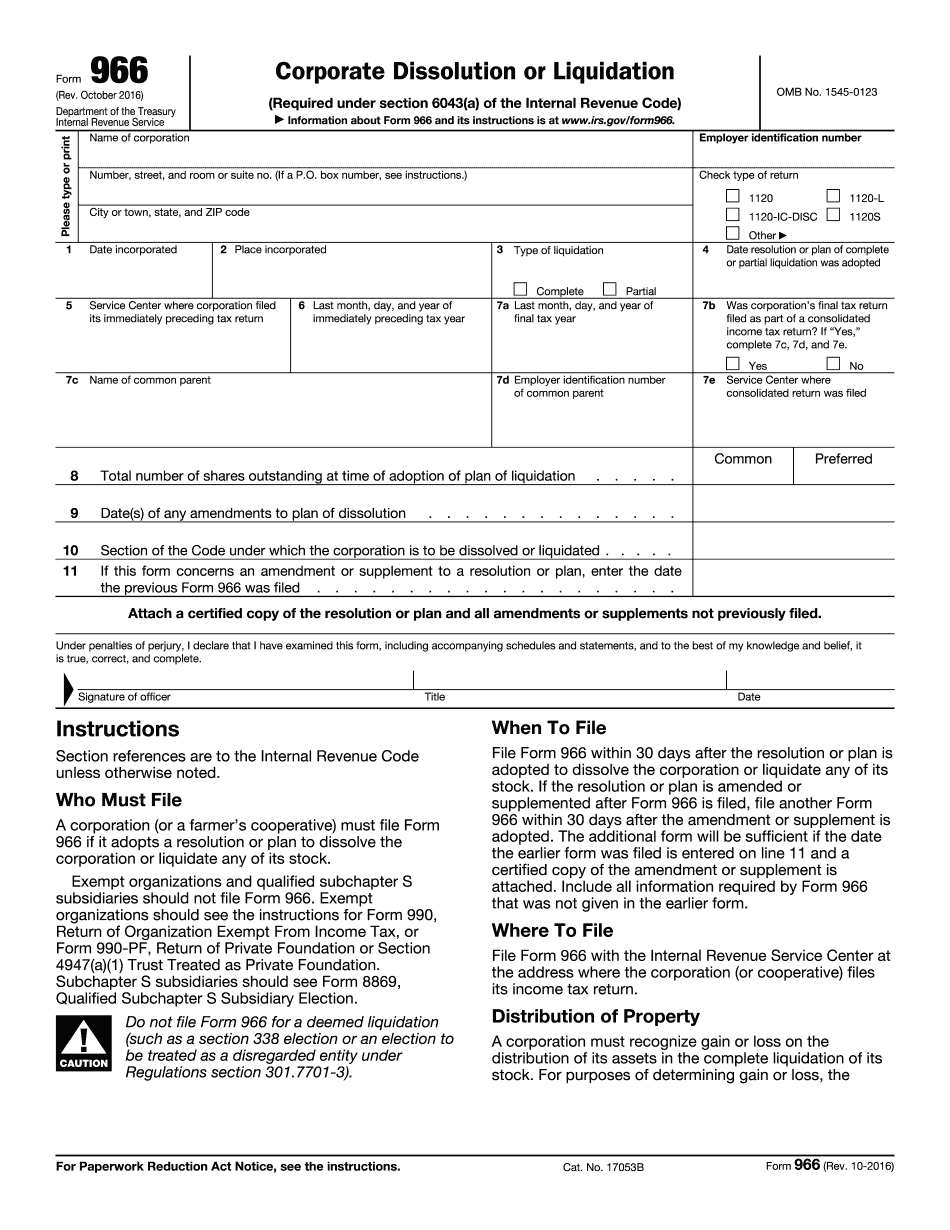

Video instructions and help with filling out and completing Where Do I File Irs Form 966