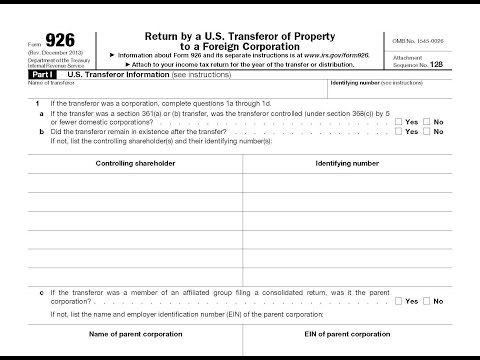

Form 926 is used to report certain transfers of property by US persons to foreign corporations. Generally, the form is required only in a corporate non-recognition transaction, such as an outbound section 351 exchange or an outbound section 332 liquidation. If the transferor is a partnership with US partners, the US partners are required to file Form 926. In Part 1, you list the name of the transferor and their US taxpayer identification number. Line 1 is completed only if the US transferor is a corporation. Line 2 is completed only if the transferor is a partnership. If the transferor is a US individual, then put their name and social security number at the top and go directly to Part 2. In Part 2, you list the name and address of the foreign corporation. Then, you list the country code on line 6 and the foreign law characterization on line 7, such as partnership or corporation. On line 8, you check yes or no whether the foreign corporation is a controlled foreign corporation, which generally means a foreign corporation controlled by US persons. Moving on to Part 3, sometimes the only type of property transferred is cash. In this case, you just list the date of the transfer and the amount transferred on the first line. If cash was transferred on multiple dates, you should attach a statement showing the amounts transferred on each date. If property other than cash is transferred to a foreign corporation, the rules are quite complex. Often, gain but not loss must be recognized on the transfers of certain types of assets, such as receivables, inventory, or property to be sold. Sometimes, inclusions in income are required, such as for depreciation recapture. Many other special rules can apply to outbound transfers of property. It is...

Award-winning PDF software

Video instructions and help with filling out and completing Where Do You Mail Irs Form 966