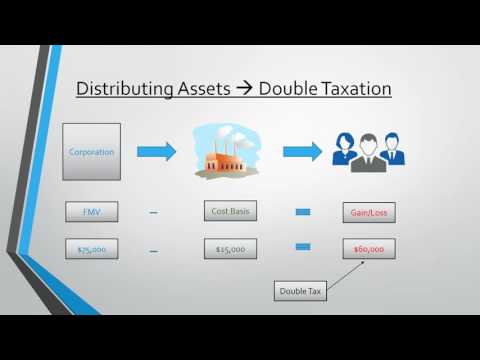

Hi, I'm Jeff Lovell, a staff accountant with an accounting firm. Today, we're going to talk about how to dissolve a corporation. There are three main types of corporate dissolutions: voluntary, administrative, and judicial. This video will focus on voluntary dissolutions by the shareholders. Shareholders can voluntarily dissolve the corporation by authorizing the dissolution and filing a certificate or article of dissolution with the state Secretary of State's office. They also need to file IRS Form 966 and then wind down operations. To authorize the dissolution, a meeting of the board of directors is held, and at least two-thirds of the shareholders must vote in favor of the motion. The vote is recorded in the meeting minutes, and a formal resolution is drafted. For smaller corporations, this entire process could be done in an attorney's office. Once the formal resolution is adopted, it is written up and signed by both a corporate officer and a representative of the shareholders. It is then submitted, along with an article of dissolution, to the Secretary of State's office. On the screen, you can see a copy of the Illinois version of the dissolution form for a sample company called Money Pit. Additionally, there is an example of the second page filled in for the same company, as well as a filled-in IRS Form 966. Once these forms are filed, the corporation can wind down its operations. It should notify various state offices, such as the Department of Revenue or the employment office, and file any final tax returns. The corporation should check the indicating that it's the final return and pay any remaining tax debts for payroll, sales tax, and income taxes. Next, the corporation should notify creditors, typically through a direct notice or a notice in the newspaper. Any outstanding claims should be settled. If there are...

Award-winning PDF software

Video instructions and help with filling out and completing Why Irs Form 966 Certified Copy Resolution