What is going on everybody? Eric the electric here, back with another video for my logic empire. But more importantly, another Easter themed challenge! It's that time of year again, when everyone goes crazy for Easter themed stuff. We've got Easter themed chocolate eggs, cereal, candy, and even goodies at fast food places. And I plan on getting all of those things for this video. Last year's Easter themed video was pretty cool, but also very cringe. Unfortunately, I only did Easter themed candy. But this year, we have so many Easter themed goodies in America and I'm getting everything for this video, not just candy. Now, it's probably the biggest price increase from last week, but hey, it's Easter, so let's do this! - Alright folks, we've got our goods, now it's time to get some more food. And we're back at Krispy Kreme. I'm super excited because apparently they have Easter themed Donuts. Let's order 15, five of each. - Now we're at Krispy Kreme donuts and they taste absolutely delicious. Still waiting on that sponsorship though. - Anyways, now it's time to get this home and make it all presentable. Guys, just pretend like that never happened. - Let me just say, guys, last week's challenge was super fun. I got to eat that massive burger, fries, and shake. But I'm excited to be back with a themed challenge. As you can see from all the food that I got, we get a ton of stuff here in America for Easter. I want to know, what do you guys go all out for Easter? We have chocolate eggs, actual eggs, and believe it or not, I was going to get some savory food like muffins from McDonald's, but I felt like it didn't really fit in too...

Award-winning PDF software

California 966 Form: What You Should Know

Form 949 — Notice of Election of Taxpayer Electors To Vote In a Special election for a Congressional Office — IRS the form 949 is filed by a corporation to provide information about any of the Corporation's stockholders who wish to vote in a special election for a Congressional office. Form 949: Form 949 (for Stockholders with certain rights) IRS Instructions: • Complete and submit the California Section 949 form. Form W-9, Return of Unused Employer Contributions — IRS Instructions: • This form is used to report unearned and unused employer contributions that a corporation has made to its U.S. business, as well as other required information. It is filed separately from Form 990, Tax Return. Form W-9: Employee Benefit Plan Information — IRS Instructions: • The form W9 forms is used by an employer to report the information it must provide when providing employee benefit plans for a U.S. tax reporting requirement. Form W-9: Employee Benefit Plan Information — California Business professions Code § 7092, Cal. Business & Professions Code § 7091, Cal. Rev. & Tax. Code § 57.11 Instructions: • Use this form to provide the employer with information regarding the employer's employee benefit plans for an income tax reporting requirement as specified by the California Business & Professions Code. Form W-8, IRS Form 8283 with California Employer Identification Number — IRS Instructions: • This form is completed by an individual to report the employment of that individual under an employer identification number (EIN). Individuals must complete this form by hand if they have any question about their employment. Form W-8, IRS Form 8282 with California Employer Identification Number — IRS Instructions: • This form is completed by an individual to report information about the employment of that individual under an employer identification number (EIN). Individuals must complete this form by hand if they have any question about their employment. Form W-8: Forms W-7 and W-8 with California Employer Identification Numbers — Cal. Rev. & Tax. Code § 3121 Instructions: • If an employer will be providing information through a California Employer Identification Number (EIN), the employer is required to submit a W-8.

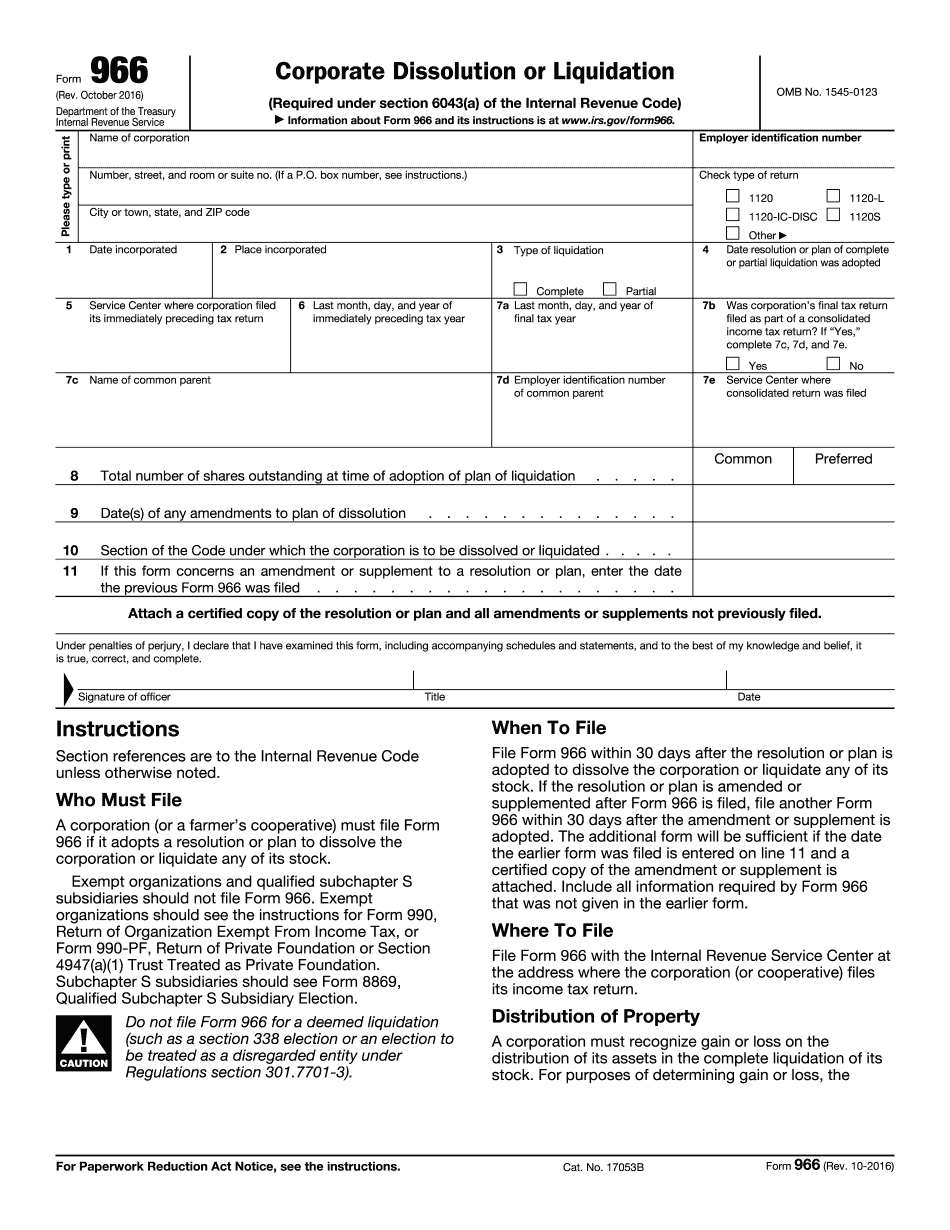

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 966, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 966 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 966 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 966 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing California Form 966