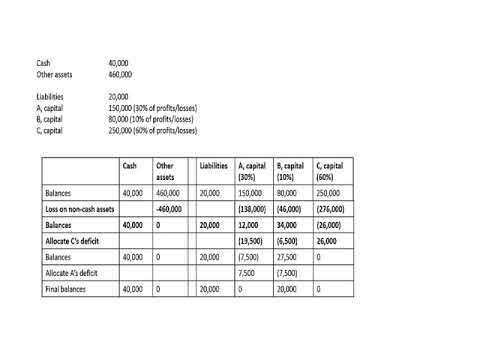

Okay, let's go ahead and talk about partnership liquidation and the topic of what's referred to as a schedule of safe payments. When a partnership is to be liquidated, the assets are converted to cash, the liabilities are paid off, and then the partners are paid their remaining capital balances. Now, the liquidation process may take a great deal of time. If the partnership wants to maximize the value they receive for their assets, they don't simply want to have a fire sale right away; they want to market it properly to appropriate customers, and it might take a long time to convert all of the assets to cash. In the meantime, the partners are going to want cash payments so they can pay their personal bills and invest in other enterprises. So, at any point in time during a liquidation process, we will be faced with a question of can we give the partners any cash, and if so, who can get how much? Now, let's assume we have the following trial balance for the ABC partnership. We have $40,000 in cash and $460,000 in other non-cash assets for total assets of $500,000. We have liabilities of $20,000. A has a capital balance of $150,000, B has a capital balance of $8,000, and C has a capital balance of $150,000. Let's go ahead and assume that A, B, and C share profits and losses in a 3 to 1 to 6 ratio. So, at this point, can any of the partners be given any cash, and if so, who can get how much? Now, at this point, we have $40,000 in cash and only $20,000 in liabilities. Creditors have first claim on the firm's assets, so of the $40,000 in cash, $20,000 has to be held back to satisfy the creditors....

Award-winning PDF software

Plan of liquidation requirements Form: What You Should Know

Sep 30, 2025 — Business activities discontinued and stock is sold to satisfy federal debt. Oct 20, 2025 — Any outstanding debt is incurred for an independent expenditure. (To complete the IRS Form 966 filing, a statement to the effect that all debt incurred for an independent expenditure is attributable to the corporation.) Oct 20, 2025 — Any remaining debt is incurred for other business purposes. (To complete the IRS Form 966 filing, a statement specifying that all debt incurred as a result of other business activities is attributable to the corporation.) Sep 30, 2040 — Any remaining debt is incurred for other business purposes, except for a payment which is made by a trustee to a trust that represents a business trust under a statute or statute of an exempt purpose. Sep 30, 2041 — Shareholders are required to vote in favor of the dissolution of the corporation. Sep 30, 2047 — All corporations are dissolved in one or more districts or districts. (To complete the IRS Form 966 filing, a statement that the corporate assets (such as a business park, a railroad station, a farm, etc.) and liabilities (such as mortgages, corporate real estate, etc.) owned by the corporation are all sold to a trust that represents one or more district trust. In addition to the district trust, the trustee must also submit a statement of the amount of all tax liability for the preceding 10 years. The district trust must also submit a copy of each tax return for all years in which there was corporate income tax liability. Sep 30, 2041 — Any outstanding bonds are redeemed. (To Complete the IRS Form 966 filing, a statement that all bonds are redeemed.) Oct 3, 2042 — All remaining stock is sold or transferred within the state. (To Complete the IRS Form 966 filing, a statement that all share equity is sold within the state.) Oct 3, 2043 — A trustee is appointed to carry out the business purposes of the corporation. (To Complete the IRS Form 966 filing, a statement that all trustees will be business persons. Sep 30, 2043 — Final sale. (To Complete the IRS Form 966 filing, a statement specifying the total amount of final net proceeds received, but not taxed, less the final cost of the transaction.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 966, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 966 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 966 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 966 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Plan of liquidation requirements