Hi, my name is Julia M. Spencer. I'm a real estate adviser and investor, and I'm your number one source for real estate advice online. I'm here next to the Matthews in via Germany. It's the highest spot, really cool if you're out there. I'm gonna show you around and show you actually how high it is. It's a really cool spot to just see the whole city, take panoramic pictures, and check out the sights from way up above. This video is about what closing costs are tax deductible when you close on a house as a buyer and as a seller. But before we get to the topic, let me just tell you a little bit about my website. It's at the bottom of this video, JuliaEmSpencer.com. Go ahead there and subscribe today to download your free guide to real estate investing. Also, make sure you check your spam folder in case some of the emails go there. You can also visit my website at JuliaEmSpencer.com, where you can purchase and download a number of audiobooks that will give you advice on all kinds of things, as well as find information about me. You can find me on Facebook, Twitter, and other social media platforms. My name is Julia M. Spencer, and somebody just took the camera, so this is perfect. Basically, in this video, we're gonna talk quickly about what closing costs are tax deductible when you sell a home. You need to know this if you're a buyer or a seller, but of course, always check with your tax attorney, closing attorney, accountant, or financial person if you have one. I actually have a list of the fees that have to be paid during a closing of a home, and I'll read them off because I don't always...

Award-winning PDF software

Closing a business tax deductions Form: What You Should Know

Mar 1, 2025 — “The sales taxes are collected by local governments and are imposed on those who engage in such activities. It is important that you know your business income tax obligations in order to keep up to date with this local, state, and federal laws.” Your local city or county may also charge or collect an average tax rate. It is imperative to have your tax returns and pay all of your business taxes regularly, even if you have a limited number of employees. To help you meet your business tax obligations, here is summary information on the sales taxes in your state. In order to understand your “Real Estate” property taxes, you must know about the local and state laws regarding the taxation of specific types of real property. Sales Tax Definitions, Taxes — State and Local Limits on Taxation. Sales Tax Definition “Sales tax” is a tax on the sale of tangible Personal Property (or for that matter, goods or services) to a consumer; for example; tangible Personal Property in the form of: • tangible or semiprecious goods • vehicles/personal property • machinery (incl. drills, cutters, grinders, saws, etc.) • buildings, houses, barns, etc. • machinery of any kind, including tools, farm equipment, or machinery, in any form (except for machinery of a household, personal use). · Real estate/buildings, and · tangible & intangible personal property.

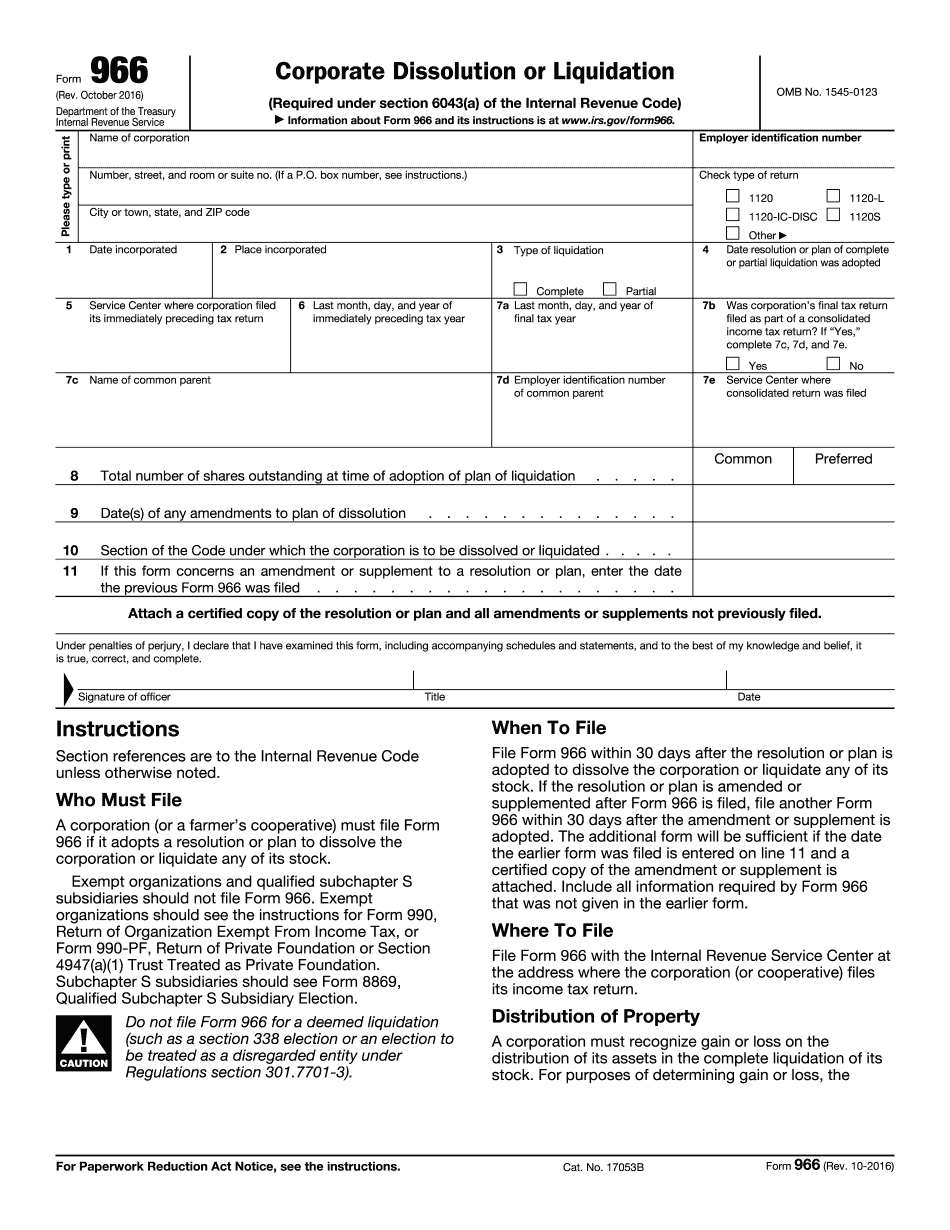

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 966, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 966 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 966 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 966 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Closing a business tax deductions