So, we know how to open a company. Have you actually closed a company? Like, let's say, "Yeah, I'll see you know, working on that anymore, whatever." You have to pay taxes on it to the government. They cannot do anything. And how do you do that? Do you just close it? That was the process thing with an LLC or corporation. You typically have to begin by, like, a shareholder remember resolution to close. You then have what's called a winding-up process where you see debts that the company owes to outside vendors, debts that the company owes to shareholders or members, distributions that are due to shareholders and members. You could do that yourself, or typically, you'd hire, like, an accountant or somebody to kind of do what's good, like a true up to see where things stand, who gets what, how much is owed. Then you would, there's at least in New York State, you do have to file a dissolution with the state in order to kind of essentially close it out, take it off the books, make it inactive. Because technically speaking, if you are a corporation in New York State, you could never do any business. No costs, no revenue, nothing. There is a minimum tax that you're going to have to pay, or that the company will have to pay, as long as it's still in existence. So, you know, as a practical matter, people in companies all the time just walk away, and it just sits there. And eventually, what will happen is, at least, if again, at least in New York State, the state will render it inactive and dissolved by law, at which point it just goes away. But in order to do it so you don't owe anything after...

Award-winning PDF software

Corporate dissolution resolution sample Form: What You Should Know

Dissolution by vote can be achieved by one/many votes or by a quorum. In all circumstances, dissolution by vote means termination of the corporation. Dissolution by vote can be achieved by one/many votes or by a quorum. If directors or members of a corporation do not comply with the provisions and conditions of the laws pertaining to formation of an authorized association, dissolution may be brought in the manner provided by law, or by the directors may be called by any of the foregoing. Corporation is formed only by and for the persons who actually are the shareholders or members of the corporation. The directors shall not have the right of voting or disposing of any corporation property unless expressly required by law. The directors shall not have the right of voting or disposing of any corporation property unless expressly required by law. The board of directors shall be a quorum, consisting of three directors, one of whom must be a natural person, and shall have the authority to act without the approval of any other director or the general membership of the corporation. If all the requirements of the conditions set forth in Section 7 of the articles have not been met by the date of the resolution, the resolution shall be binding and all actions in furtherance of the dissolution shall be the actions of the corporation. Form 990 — Corporation Guide For most non-resident US and Canadian corporations, here's Form 990 form, for information and advice on how to report your taxes. Form 990, U.S. Government 990 — This information includes information such as: — Gross receipts and sales reported to the Internal Revenue Service for the taxable year; — Gross receipts from continuing operations, other than sales of inventory; — Net earnings from continuing operations and any unrealized gains or losses; — Earnings per share; — Employee benefits; — Income and expenses attributable to real property held for investment or for sale; — Other items required to be reported; and — Other information required. Form 990, International Organization, State, County, and Municipal This Form 990 is available to the Public Library of India Form 990-EZ, Income from Business. Form 990-PF, Part III — Profit and Loss from Business.

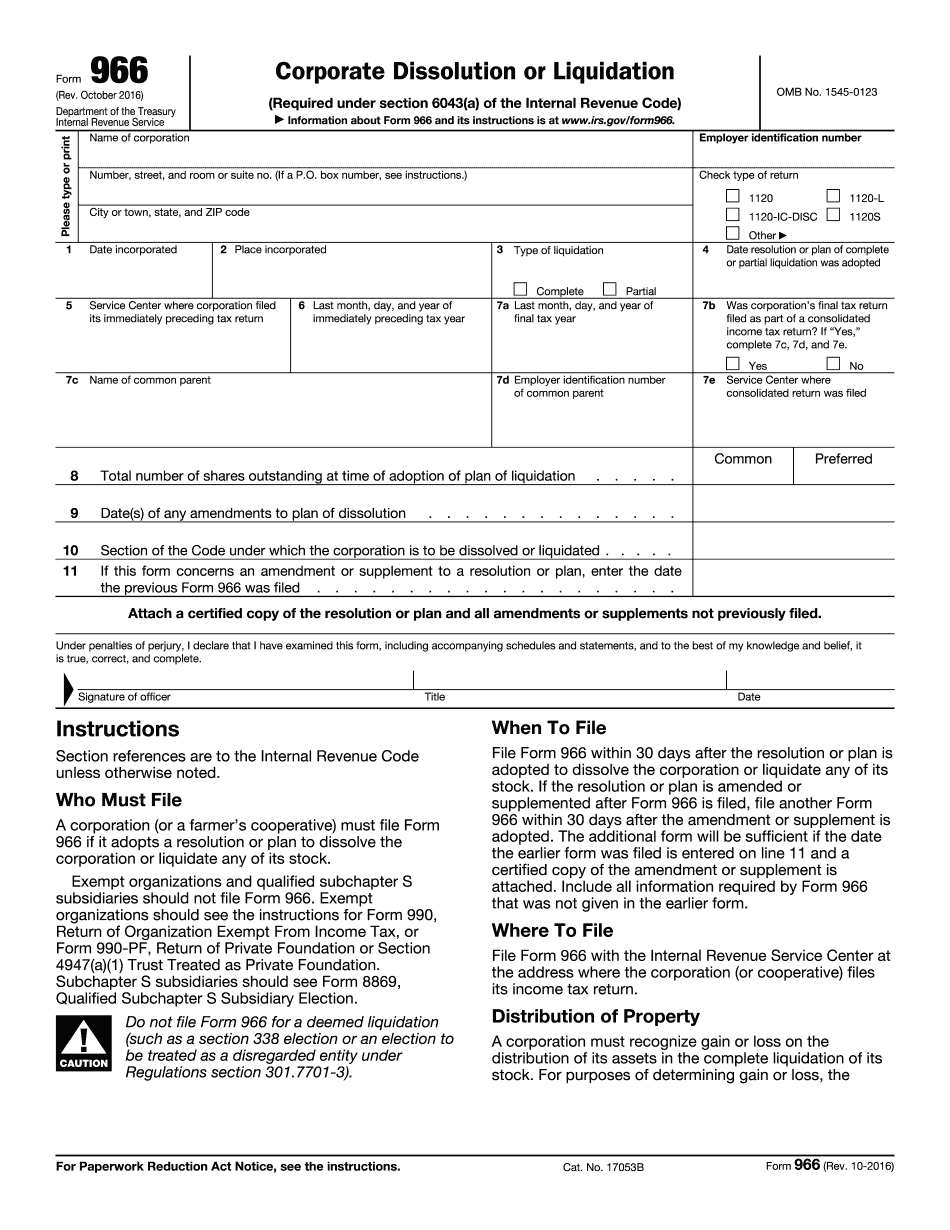

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 966, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 966 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 966 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 966 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Corporate dissolution resolution sample