Talking about corporate stocks, this time we've already talked about them a little bit. We talked about how people set up a corporation and then divide it up into shares. As the company grows, more shares are issued and some people sell their shares. It's a way of creating an organization that works. We also mentioned the first real corporation with traded shares, which was the Dutch East India Company in 1602. This idea took hold and became a popular scheme for organizing businesses worldwide. I have had my own personal experience with creating corporations. The first time was with one of my students here at Yale, Alan Weis. He wasn't an undergraduate, but he was getting an MBA from the School of Management. After he graduated, he approached me and expressed his interest in starting a company to sell home price indexes, which I create. I agreed to advise the company, and together with my colleague Chip Case from Wellesley College, we formed a corporation called Case Shiller Weiss Incorporated. We also brought in a real businessman who didn't want his name on the company. Instead, we used his check for funding. Since I couldn't dedicate much time to the company due to my teaching commitments at Yale, we had to determine how many shares each of us would receive. The only person who contributed money was the businessman, while the rest of us agreed to contribute our time. It was a question of how to fairly divide the company when the businessman invested money, and I invested time. Eventually, we decided to divide it equally among the four of us. Despite not becoming a large company, we sold it to Vice Irv Inc. in 2002 when we had 12 employees. Later on, S&P purchased the indexes, and now they are...

Award-winning PDF software

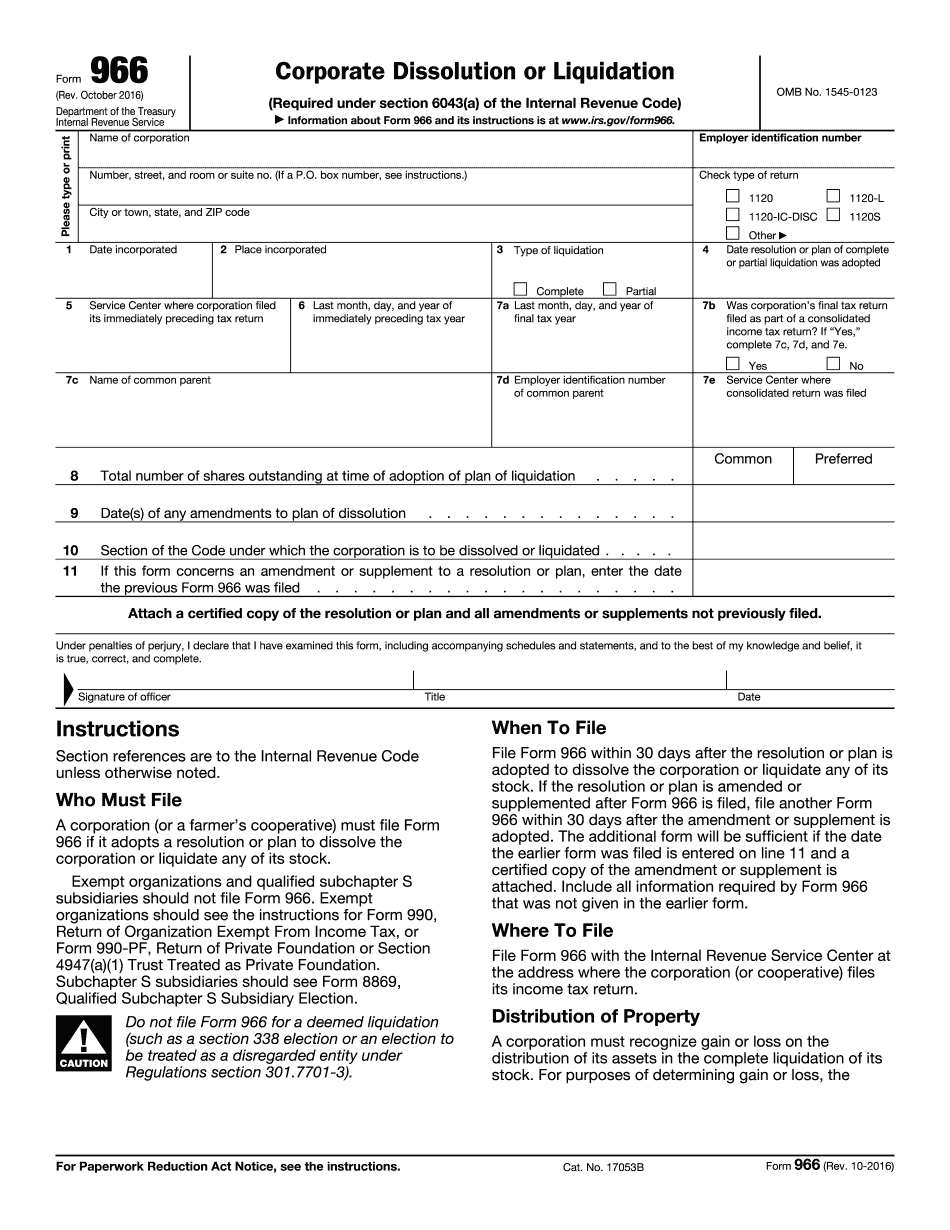

Total number of shares outstanding at time of adoption of Plan Of Liquidation Form: What You Should Know

Number of shares outstanding at time of adoption of plan of liquidation Form 963 (New) The IRS Form 963 is used to dissolve and liquidate a corporation for tax purposes. Total number of shares outstanding at time of adoption of plan of decommission/conveyance (New) Decommission/Conveyance IRS The IRS Form 963 is used to dissolve and liquidate a corporation for tax purposes. How To Pay Tax A corporate dissolution and liquidation means that the corporation is no longer active. The IRS may be a debtor in a bankruptcy. The corporate dissolution and liquidation process is completed in the year in which the tax obligations are owed. The IRS often has to levy a debt before it can complete the tax liability of the corporation. A debt owed by a corporation is often called a statutory tax debt or statutory tax lien. This debt is also called a statutory interest claim due. The tax debtor in a corporate dissolution and liquidation is the corporate estate. The tax debt is the debt that must be paid by the corporate estate, not the corporate income tax debtor (the corporation that owes the tax debt). The statutory tax debt exists because the corporate estate has failed to meet its statutory tax obligations. If there is no tax due the IRS typically makes a good faith effort to collect the tax debt. In some situations, the IRS may use a court order to order the corporate estate to pay the tax debt, but it can also be done without court intervention. After the corporate estate files a Notice of IRS Demand for Payment or a Debt Validation Letter, the IRS can levy the estate's income and proceeds. The IRS may also levy a portion of the corporation's remaining assets for its tax obligation. In some circumstances, the IRS may also be able to levy a portion of the corporate estate's estate taxes on the estate itself. How to pay tax on income is done by using Form 4868. See Publication 525, Interest and Dividends See Publication 522, Tax Guide For Foreign Corporations This tax code requires certain information be forwarded every year to the U.S. Department of the Treasury in the form of a notice from the IRS.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 966, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 966 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 966 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 966 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Total number of shares outstanding at time of adoption of plan of liquidation