Award-winning PDF software

Anaheim California online Form 966: What You Should Know

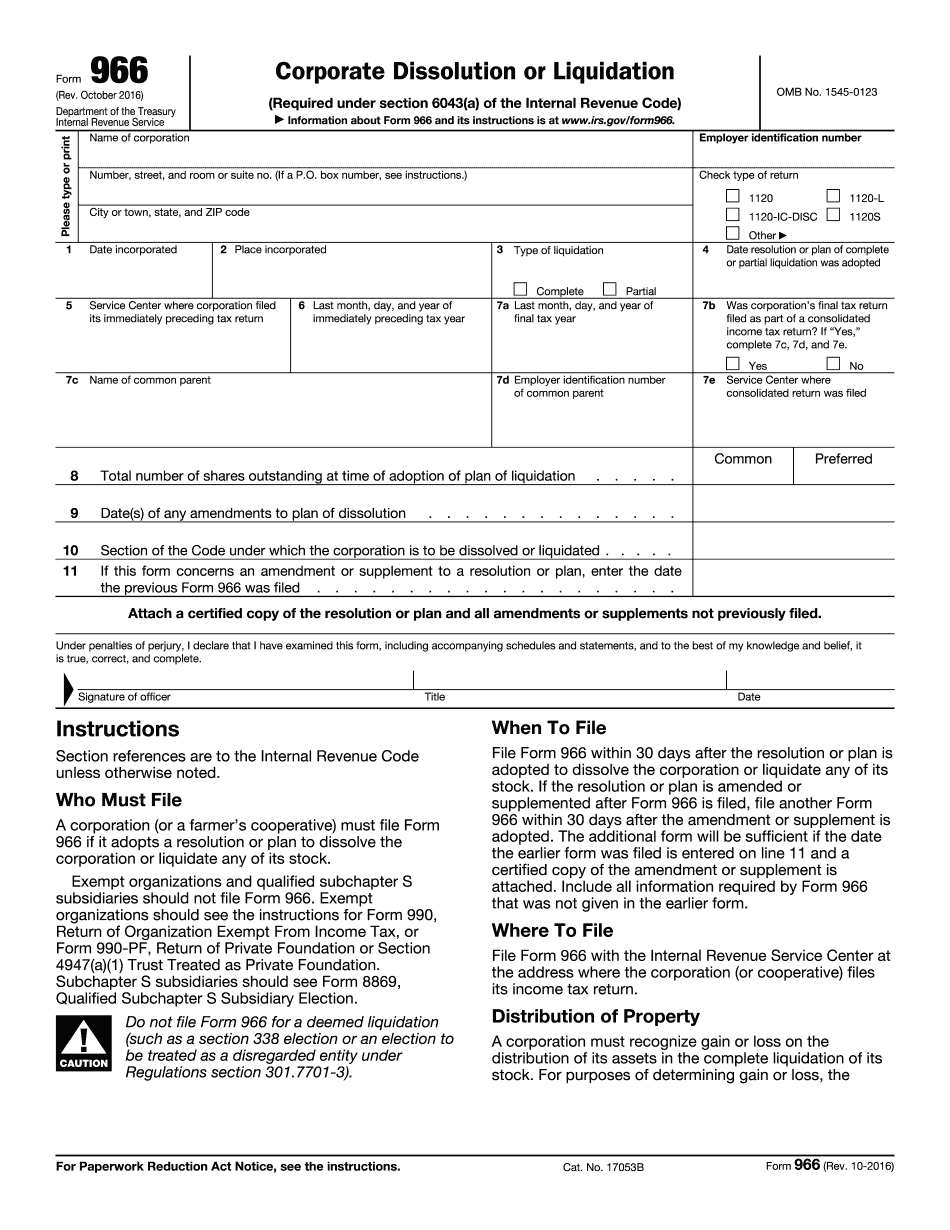

The IRS also uses Form. 966 to close down a non-profit charity if the sale of assets or business assets could not generate enough income to cover the expenses of operating and maintaining the charity. The non-profit or charity will remain a 501(c)(3) or a 501(c)(6), and tax benefits may be received and/or the company may still have all remaining assets after the sale. You do not need to use Form 966 if the sale does not reduce your taxable income below the amount that would result if you had elected to liquidate the company. Form 966, “Custody and Disposition of Corporate Asset Sale” (Rev. October 22, 2016) is the actual form that a shareholder can file when liquidating his or her company. If a shareholder has a business or other taxable interest in the company's assets that the shareholder desires to liquidate, you may not need to file Form 966, “Custody and Disposition of Corporate Asset Sale.” However, an exception to this is if the company is not a C corporation and the company's assets exceed 25,000. You can file Form 966 to liquidate company assets for the remainder of the entity's tax year and any of its prior tax years, however, the sale must be in compliance with the regulations of your county and the county's law enforcement agency. A shareholder must have a written agreement to liquidate the company for its tax year and its prior tax years with the county and law enforcement agency before liquidating the company, and the written agreement must be submitted to the county and law enforcement agency for approval. A timely request by a shareholder for approval cannot be denied because of a “credible threat” of terrorism, an “economic downturn” or other threat to life or property. The approval will be contingent on a completed business audit, or a completed written examination of the business. The local county and law enforcement agency will be notified if the company is liquidated for a tax year and prior tax years. The county and law enforcement agency, and any taxpayer affected by the sale, will receive a letter (a “Notice of Liability”) from the law enforcement agency stating that the sale will proceed as planned. The taxpayer will be issued an IRS Form 966 (Rev.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Anaheim California online Form 966, keep away from glitches and furnish it inside a timely method:

How to complete a Anaheim California online Form 966?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Anaheim California online Form 966 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Anaheim California online Form 966 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.