Award-winning PDF software

Daly City California online Form 966: What You Should Know

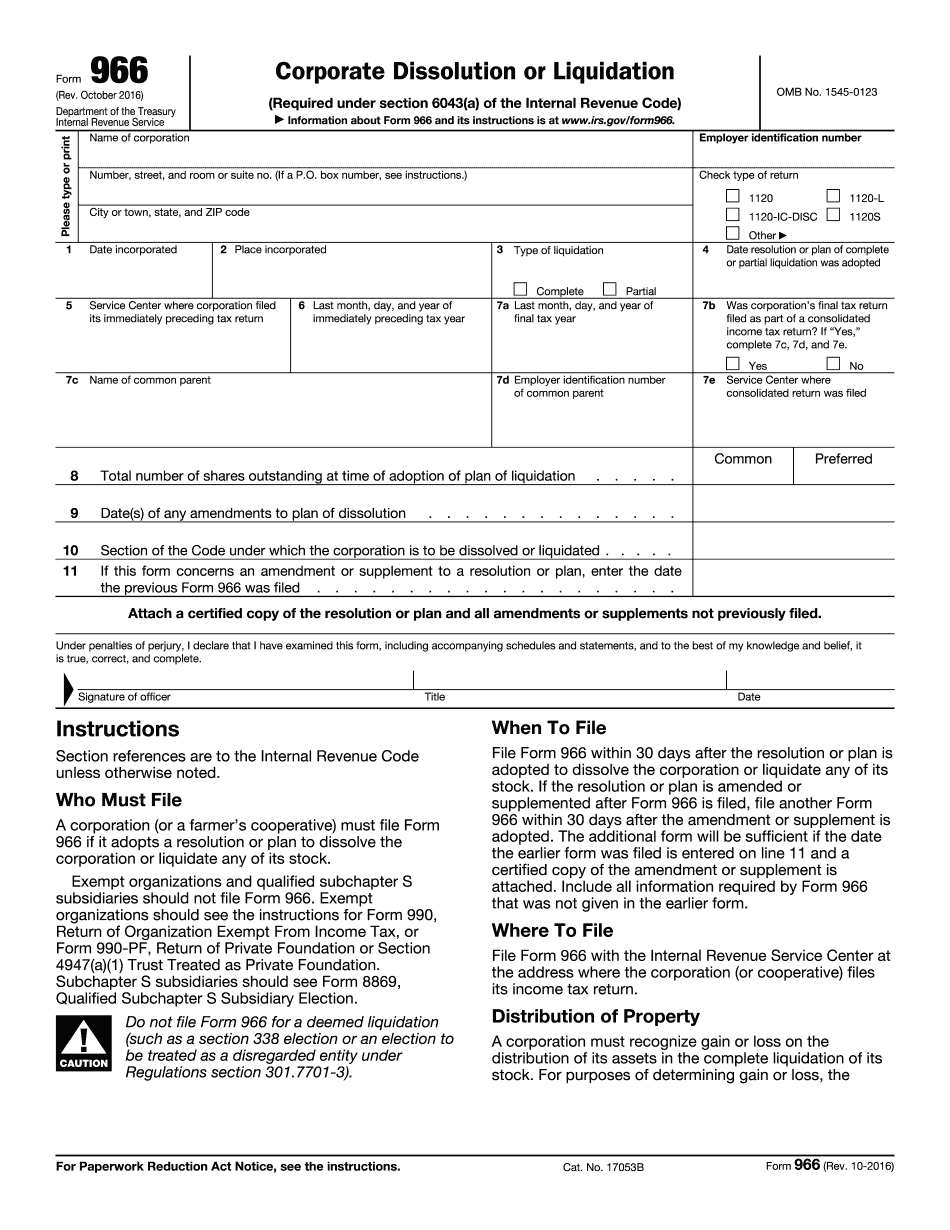

That means, the corporation has two or more shareholders who are eligible to participate in the annual shareholder meeting (e.g., individuals or farmers), and a minimum of 300,000 (based on a 10% dividend paid annually) in taxable gross income. “Consequently, Form 966 is usually filed before the next annual shareholder meeting. “The information on Form 966 covers the corporation's assets, liabilities, business activity (including sales and use tax and other tax payments), and tax effects on the corporation. “To apply for Form 966, see the following publication: Guide for the Retailer and Farmers' Cooperative Income Tax (IRS Publication 17). Form 966 (Rev. July 2018) — IRA/IRA Application To apply for Form 966, you must apply to your IRA's administrator. To see how this process can be completed in California, please go to California's IRA / IRA section. See California IRM 21.3.1.1.1.5 (5.3) and Example 19, where the taxpayer will make Form 8809 or Form 8909. Example 19 — Calculation of California Income Taxes I. INCOME TAXES on FISHING PRODUCING COMPANIES (E-CREPES) and TRADING CORPORATES Calculate the tax paid by fishing companies. Calculate the taxable income for the fishing companies. Calculate the amount of income (profit) attributable to fishing and trade producing corporations. Determine whether the fishing company's net profits are exempt from California's gross receipts tax (GTR) exemption from the state. See IRM 21.1.4.13.5.1.4 for tax exemption provisions affecting fishing companies. IRM 11.1.4.9 .6.3.7.7.8 .5, .5, and .20. The taxpayer is permitted to deduct the sales price of the fishing boats they purchase and the rental income received when they operate them. In this way, fishing company owners benefit from deductions that are available to the owners of other businesses.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Daly City California online Form 966, keep away from glitches and furnish it inside a timely method:

How to complete a Daly City California online Form 966?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Daly City California online Form 966 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Daly City California online Form 966 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.