Award-winning PDF software

Form 966 online Carrollton Texas: What You Should Know

Tax Assessor's Office of Dallas County, Inc. Filing for Corporate Tax Deduction in Texas Corporate income tax deduction is available to all Texas taxpayers, but the Texas corporate income tax deduction rate is 5.0% which applies to corporate income tax on their gross receipts less allowable deductions. As with all Texas state income taxes, there is no state or local tax deduction. It is important to note that while a small corporation may be able to claim a deduction for 100,000 or less, most corporations must claim a deduction for their total gross receipts. For more information on Texas corporate deductions, visit the Texas Small Business Tax Guide. Texas Small Business Tax Guide Corporate Tax Deduction for Texas Corporate Income Tax Texas Corporation Income Tax Deduction Limits This article was published in the May 2025 issue of Texas Small Business Tax Guide. You can get a free copy of the Texas Small Business Tax Guide, by visiting . State Income Tax Deduction Limited for Corporations in Texas The tax rate is 5% which applies to corporate gross receipts plus allowable deductions; however, a taxpayer may deduct corporate income tax from their tax liability at the lower statutory rate of 2% (this amount also depends on the size of the corporation). Other Texas State Tax Reducibility For Corporations Corporation tax is imposed on all companies with more than ten shareholders. Corporate Tax Deductible Business Expenses Corporate tax-deductible business expenses include employee compensation, legal and professional services, property, and tangible property. For further information, contact the Secretary of State's Office. Companies in Texas can make deductions for business-related expenses and their associated tax consequences. The corporate income tax is charged on corporations gross receipts less allowable deductions. Corporations with more than 10 shareholders may also deduct their expenses to the extent that the expenses are deductible for a limited number of companies. The maximum deduction allowable is 5% of gross receipts. For additional information, contact the Texas Secretary of State. Texas Corporation Income Tax Deduction Rates for Corporations with 10 or More Shareholders State corporation income tax rates generally apply to corporations with more than ten shareholders. However, the Texas corporate income tax rate is 5%. The deduction limit is 2,500 for corporate tax years beginning in 2025 and 2025 and 5,000 for corporate tax years beginning in 2025 and up to 2012.

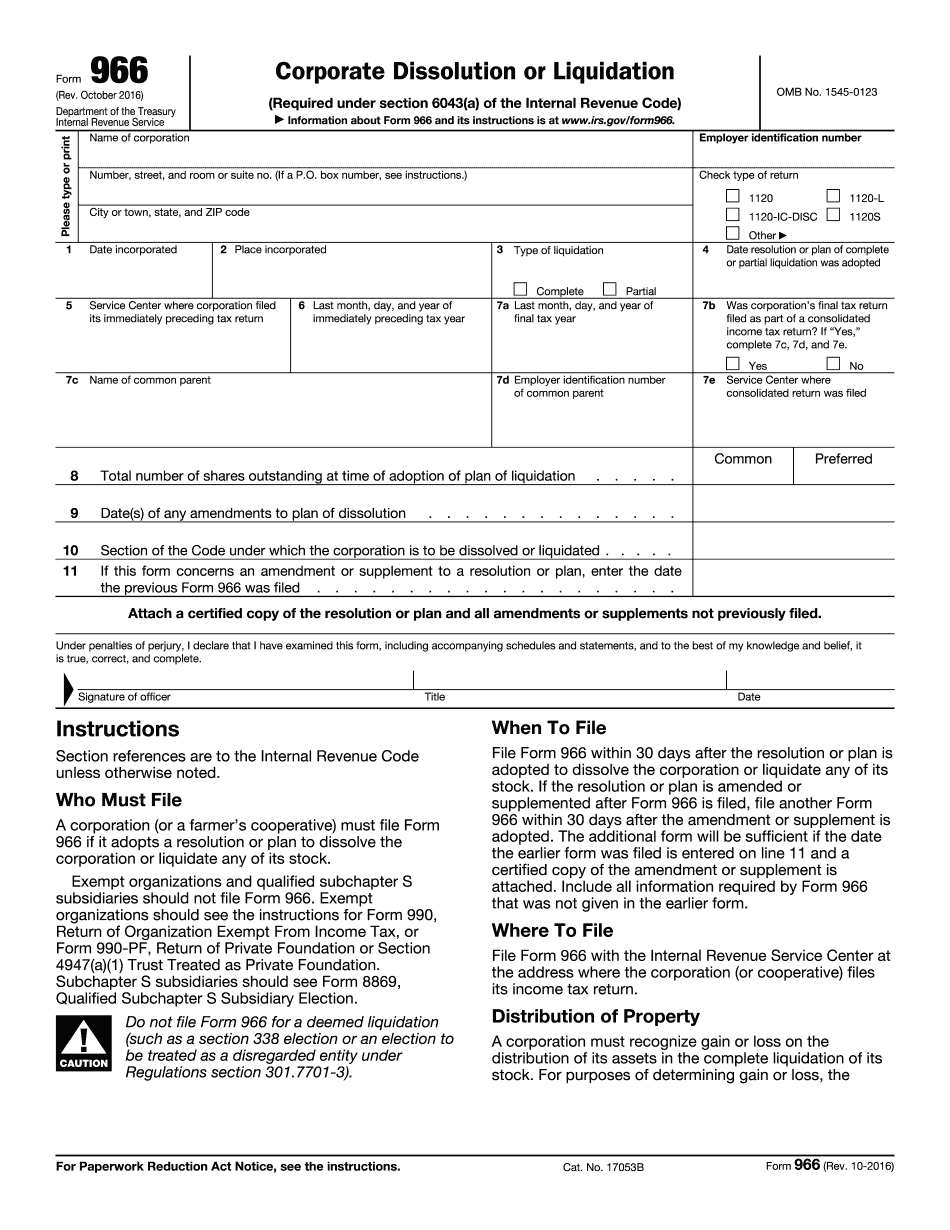

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 966 online Carrollton Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 966 online Carrollton Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 966 online Carrollton Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 966 online Carrollton Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.