Award-winning PDF software

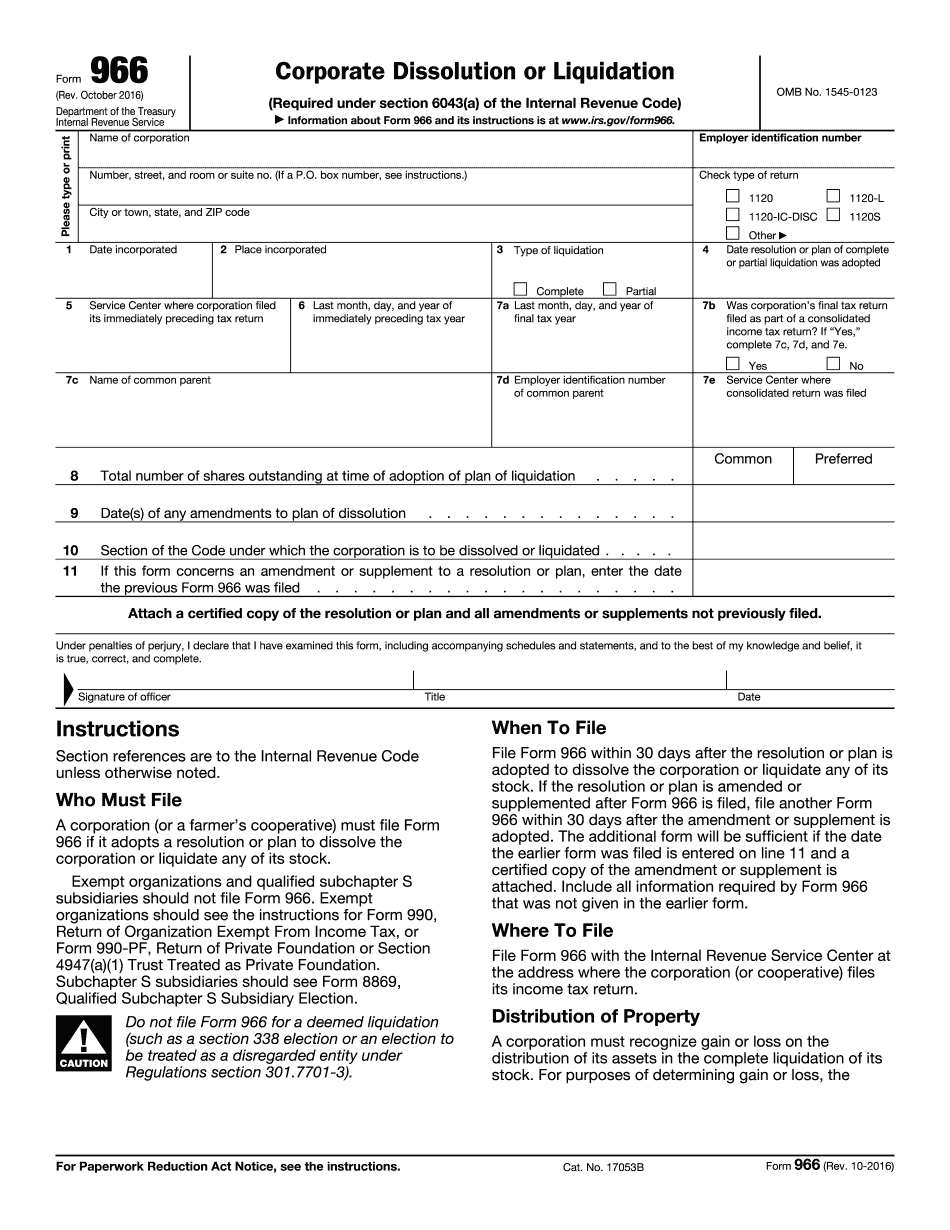

Las Vegas Nevada Form 966: What You Should Know

In the first answer to the question, I say that I do know of no law that requires an entity to file a form 966 if it is about filing a resolution to dissolve, liquidate (or otherwise take control of an entity), and I do have the information I need. Now, at any time from 12:01 a.m. on Nov 11, 2017, to 11:59 p.m. on Dec 31, 2025 and not earlier than 12:01 a.m. on Jan 1, 2025 (but not later than the end of the 12-month period beginning on Nov. 11, 2017), I should be able to furnish this kind of information to you and a third party you have invited to submit questions. I would suggest that you send me a text message stating that you have received this request. I am a U.S. bank. Furthermore, I may be able to make a payment (as the bank). Furthermore, I would pay a fee of 8 – 10 for providing you, either the recipient or a third party, with this sort of information (the fee would be dependent on the information requested or requested information becomes readily available). In the case of your call, it is for legal advice rather than for legal fees. As for the third party you have invited, perhaps you ought to ask them whether they might be able to help you with your question regarding what entity is to be dissolved/liquidated (or is doing anything else), whether any third parties in the United States should be contacted regarding that or any other question or need, etc. My firm provides “assistance” in many forms of corporate dissolution & liquidation situations. I could be of use to you, or may even be able to provide information that would be useful to you. If interested, contact me via email at [email protected] or via my office's phone at. If I find that any information I provide to you is useful to you, I may forward the information to another third party, such as a lawyer, by providing a request form on my firm's website:. Also, I may be able to do you some good in other ways. In one such instance, my firm did a corporation liquidation and filed a form 946 with the Internal Revenue Service.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Las Vegas Nevada Form 966, keep away from glitches and furnish it inside a timely method:

How to complete a Las Vegas Nevada Form 966?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Las Vegas Nevada Form 966 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Las Vegas Nevada Form 966 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.