Award-winning PDF software

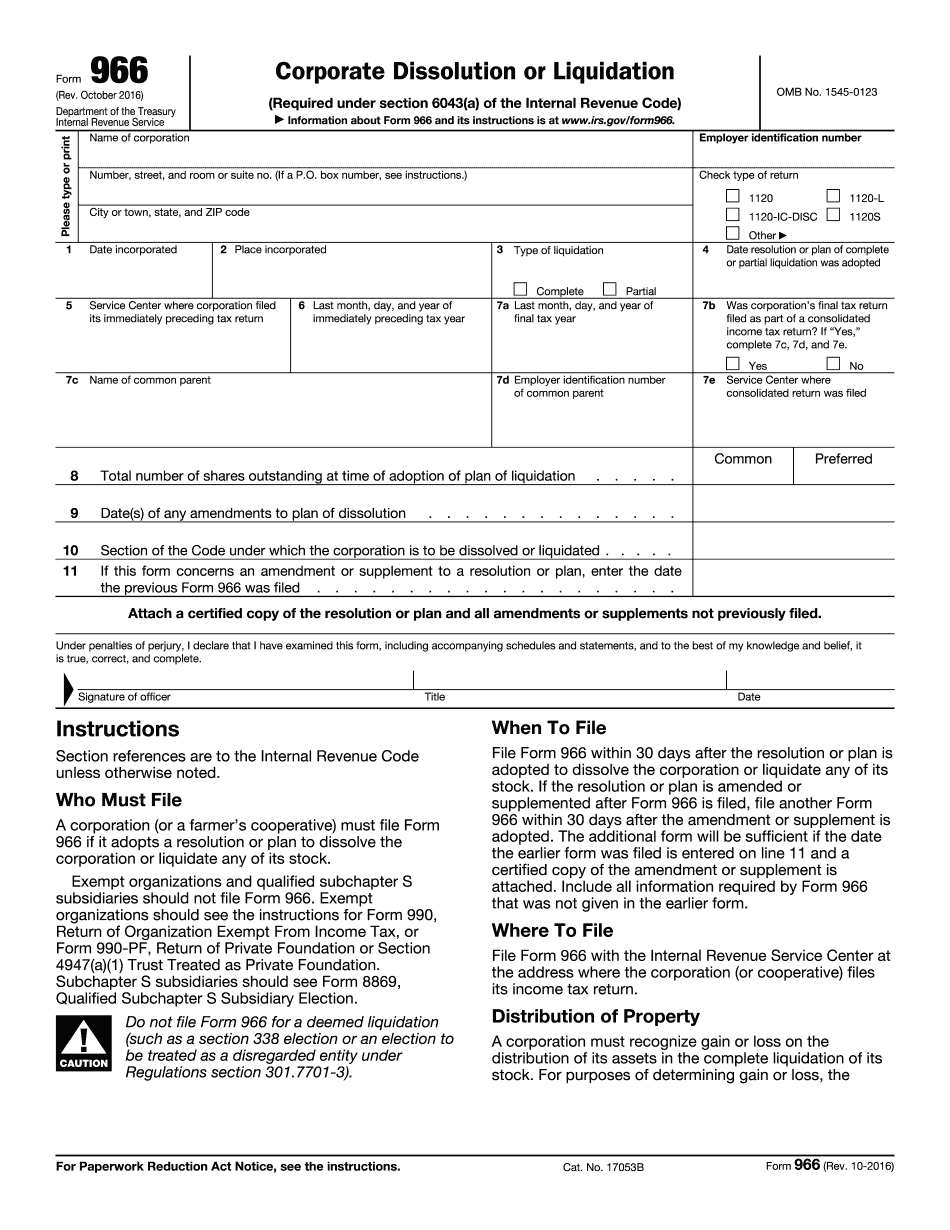

Form 966 for Wyoming: What You Should Know

Wyoming corporation by filing Wyoming dissolution papers & Instructions (PDF) and fillable form 966 (PDF) Wyoming corporation by filing for dissolution in Wyoming. Wyoming LLC or corporation by filing for dissolution. A Nonprofit Corporation that is owned at all times by the IRS as an asset. The non-resident entity must be a corporation and the non-resident entity may not have more than 50,000 in taxable income in a given year. How much taxable income the non-resident entity may have is determined under Internal Revenue Code section 7701(10) and is calculated by taking the average of the taxable income or loss of all non-resident entities of the non-resident entity, if any, in all prior years. This value, which is usually found in Section 1023 of the Internal Revenue Code, is a percentage, called the “controlled foreign corporation” threshold. As a part of the tax code provision, the IRS has identified the non-resident entity as the controlling entity until the “controlled foreign corporation” threshold is reached or extinguished. However, the IRS permits non-resident corporations to have more than one controlling entity. The IRS also limits the amount of income that can be excluded because of the non-resident entity's status. What can I expect? In practice, the IRS won't require the non-resident entity to file a Form 966 when it's dissolved or liquidated. Non-residents may have an additional limitation that prevents them from claiming losses in certain situations. The non-resident entity that is dissolved or liquidated may be required to file a Form 966, however, if that non-resident entity, either in whole or in part, is a “domestic private entity.” If your non-resident entity will be a domestic private entity until the “domestic private entity” threshold is reached or extinguished, no Forms 964 will be required. Your non-resident entity won't necessarily have to file Form 966 to close a company under New Jersey or Massachusetts law, for example. The term “domestic private entity” means a “for-profit corporation, limited liability company, partnership or other entity not organized or doing business in the United States, that is not an eligible foreign corporation and that does not have more than ten percent (10%) of its gross income from sources in the United States.” If the non-resident entity doesn't get required forms due to its lack of status, that's a violation of IRS rules.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 966 for Wyoming, keep away from glitches and furnish it inside a timely method:

How to complete a Form 966 for Wyoming?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 966 for Wyoming aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 966 for Wyoming from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.