Award-winning PDF software

Form 966 for Tampa Florida: What You Should Know

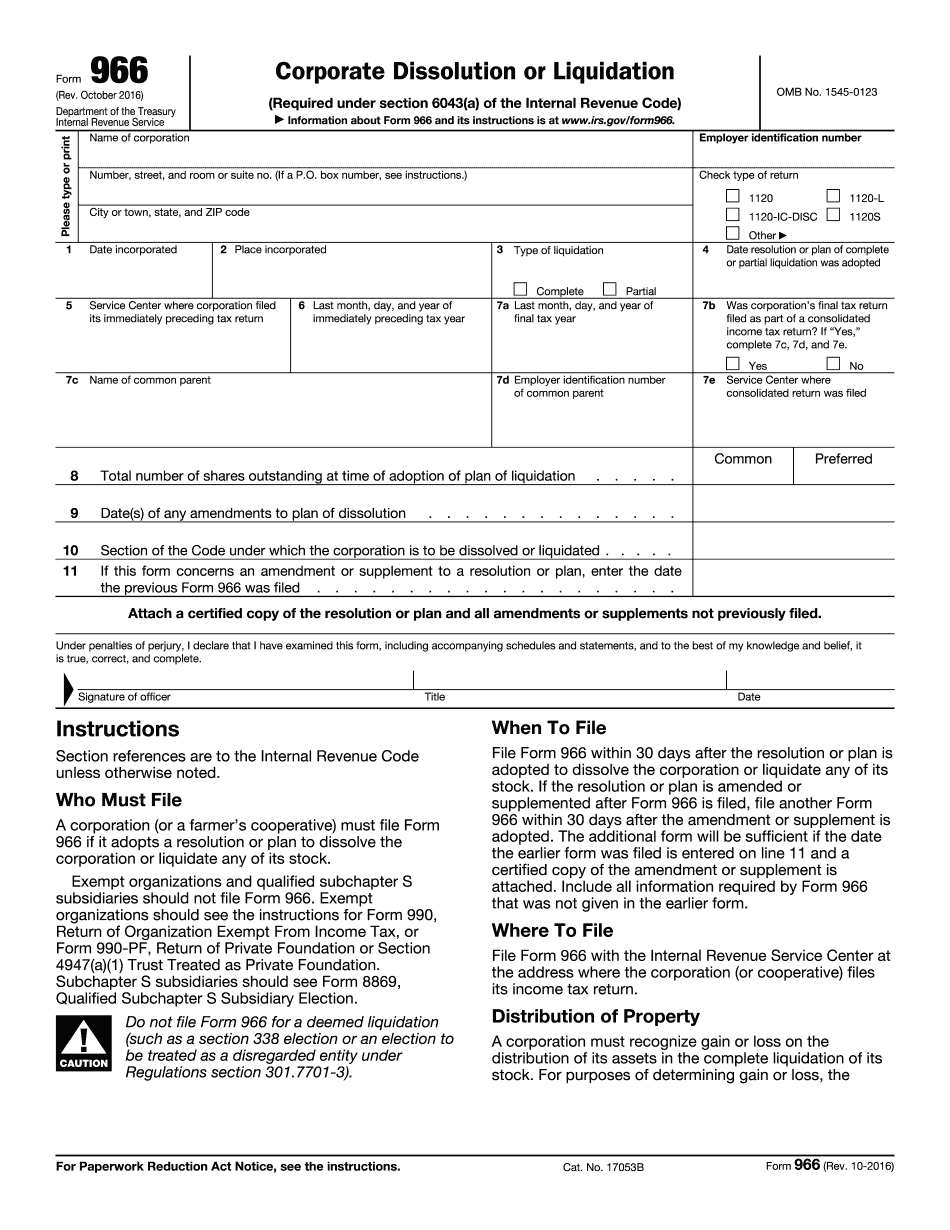

Summary Judgment) which will supersede the old one (see above). This rule now applies to all family law proceedings, including: divorce, separation, child custody, alimony and child support. This new rule does not apply to civil actions with an element of fraud, false pretenses, or concealment of material facts. In addition, it gives a much stronger voice to attorneys, who now are able to testify that they were acting on behalf of the corporation, not on behalf of or in the best interest of the corporation. It also sets up new rules for corporations with less than ten year old stock. Form 966 (Rev- October 2018) — IRS A corporation (or a farmer's cooperative) must file Form. 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. How to file Form 966, Corporate Dissolution or Liquidation — IRS May 14, 2025 — As stated in the 2 Annual Report filed by the S corporation, the entity has adopted a resolution or plan to dissolve or liquidate the corporation within 90 days of the filing of its first annual report. Form 966, Corporate Dissolution or Liquidation — Counsel Form 966 Corporate Dissolution or Liquidation is the IRS form that must be filed when closing down an S corporation. Incorporation Forms for Corporations With Less than Ten Years Old Stock — Florida Law Weekly As of January 1, 2020, Section 18-1028.3-14(4) shall apply to these corporations. How to file Form 966, Corporate Dissolution or Liquidation — IRS July 31, 2025 — A corporation (or a farmer's cooperative) must file Form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Form 966 Corporate Dissolution or Liquidation — Counsel For more information see the Florida Business & Professions Code section 1-521 which states that corporations must file for dissolution or liquidation at their regular time to have the necessary notice and filings made. If a corporation has fewer than 10 years old taxable income from all sources of income, and is in the course of liquidation or dissolution, you should not do any work. You should simply file a Notice of Dismissal at the time of the company's liquidation or dissolution.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 966 for Tampa Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 966 for Tampa Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 966 for Tampa Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 966 for Tampa Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.